Is San Diego Right for You?

San Diego attracts out-of-state relocators with its year-round 70°F weather and beach lifestyle, but living comfortably requires a minimum annual income of $85,000-$100,000 for single professionals and $110,000-$145,000 for families, with housing costs consuming 60-70% of income compared to the national average of 30%. The city’s cost of living sits 46% above the national average, making financial preparation essential before relocating from lower-cost states like Texas, Florida, or the Midwest.

Let me be straight with you—I’ve watched dozens of friends make the San Diego leap over the past few years. Some absolutely love it and can’t imagine living anywhere else. Others? Well, they’re back in Austin or Atlanta, tail between their legs, wondering what the hell they were thinking.

The thing is, San Diego sells itself. Those Instagram photos of La Jolla Cove don’t lie. The weather really is that perfect. But nobody posts pictures of their $3,200 rent for a one-bedroom apartment or their $400 electric bill in August. That’s the stuff we need to talk about.

The Financial Reality: What You Actually Need to Earn

Income Requirements That Actually Work

Here’s what I wish someone had told me before I moved here: if you’re making less than $85K as a single person, you’re going to struggle. Not “ramen noodles for dinner sometimes” struggle—I mean “choosing between gas money and groceries” struggle.

My friend Jake moved here from Phoenix making $75K, thinking he’d figured it out. Six months later, he was sleeping on an air mattress in a shared room in Clairemont, eating peanut butter sandwiches for lunch every day. Don’t be Jake.

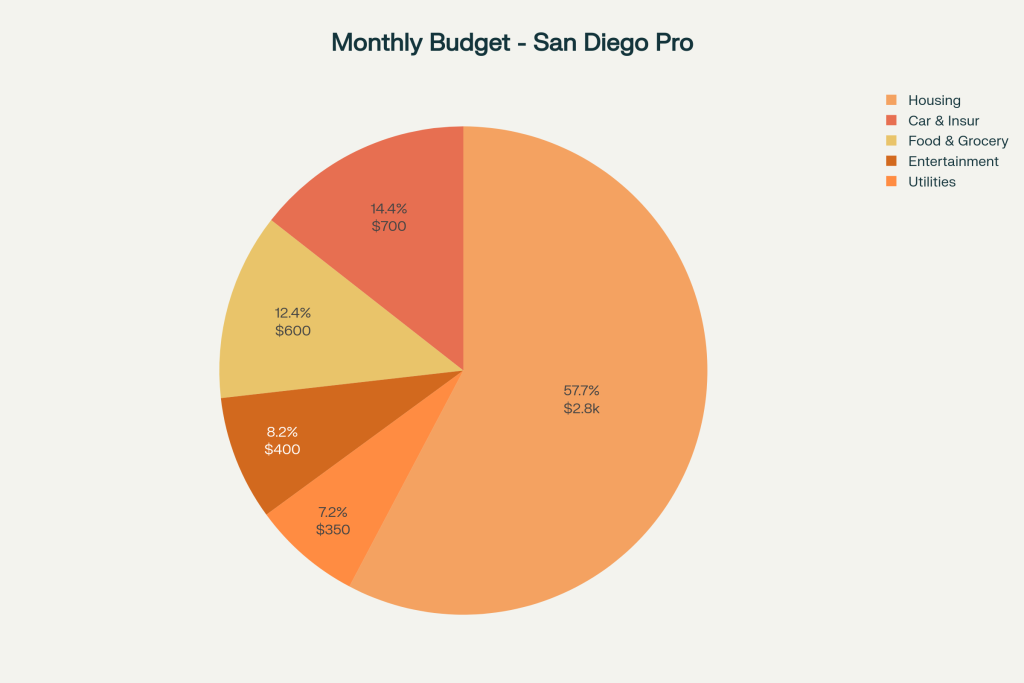

For single professionals, you need $85,000-$100,000 to live decently. That breaks down to:

- $2,500-3,000 for housing (and good luck finding anything decent under $2,800)

- $600-800 for your car payment, insurance, and gas

- $500-700 for food and groceries

- $300-400 for utilities

- Whatever’s left for actually enjoying this expensive paradise

Families need even more—we’re talking $110,000-$145,000 minimum. I know a couple with two kids who moved from Nashville. He’s a software engineer making $130K, she’s a nurse pulling in $80K. They’re comfortable, but they’re not living large. Their mortgage on a modest 3-bedroom in Mira Mesa? $4,800 a month.

🌴 San Diego Cost of Living Calculator

The Cost of Living Reality Check

That 46% higher than national average isn’t just a statistic—it’s your daily life. When you’re paying $6 for a basic sandwich at lunch or $18 for a cocktail downtown, you feel it. Every. Single. Day.

Coming from Texas? Multiply your current expenses by about 1.8. From Florida? Same deal. The Midwest? Oh honey, you’re in for a shock.

The most brutal part? Housing eats up 60-70% of your income here versus the recommended 30% nationally. Yeah, you read that right. Most people I know are house-poor, and they’ve made peace with it because… well, look outside. It’s 75 degrees in January.

Housing: Your Biggest Expense Decision

Rental Market Reality

The rental market here is absolutely bonkers. I’m talking multiple applications, credit checks that cost $50 each, and showing up to viewings with your financial life laid bare in a folder, praying the landlord picks you over the other 20 applicants.

Current rental prices will make you weep:

- One-bedroom apartments: $2,438-$2,975/month

- Two-bedroom places: $3,200-$4,500/month

- Houses: Start around $3,500 and go up, up, up

And that’s just rent. Add first month, last month, security deposit (usually 1.5-2x rent), and boom—you’re looking at $8,000-$12,000 just to get keys in your hand.

My neighbor spent three months living in extended stay hotels because he couldn’t secure a place. THREE MONTHS. The application process is like applying to college all over again, except more humiliating.

Neighborhood Guide by Your Actual Budget

Let me break this down by what you can actually afford, not what the real estate websites tell you:

If you’re making $120K+ (Premium Areas)

La Jolla, Del Mar, Carmel Valley—these are your playgrounds. Expect $3,500-$5,000 for a decent place. La Jolla is gorgeous but feels like living in a retirement community where everyone drives a Tesla. Del Mar has that beach town vibe but good luck finding parking. Carmel Valley? It’s basically suburbia with better weather.

Making $90K-$120K (Mid-Range Options)

Hillcrest, North Park, Mission Valley—this is where most transplants end up. North Park has the best food scene and walkability, but it’s gotten expensive fast. Hillcrest is centrally located and LGBTQ+-friendly. Mission Valley? It’s growing on me, especially with all the new development, but it can feel a bit soulless.

Under $90K (Budget-Friendly Areas)

Logan Heights, Lincoln Park, Chula Vista—don’t let anyone tell you these areas are “bad.” They’re just not as shiny. I lived in Logan Heights for two years and loved it. Great Mexican food, actual community feel, and a 15-minute drive to downtown. Chula Vista is basically San Diego’s suburbs, but hey, you get more space for your money.

Homebuying: A Different Kind of Painful

Want to buy? Hope you’ve got $190,000 sitting around for a down payment, because the median home price is hovering around $950,000. And that’s for something that would cost $200K in Ohio.

I watched a bidding war last month where a 1,200-square-foot house in Normal Heights (not exactly Beverly Hills) sold for $875,000. The winner? Cash offer, $50K over asking, no contingencies.

Property taxes aren’t terrible compared to other states, but when you’re paying them on a million-dollar house… yeah, it adds up.

Transportation: Getting Around America’s Finest City

Why You Need a Car (Sorry, Transit Lovers)

I came from Portland, where I could bike or take transit everywhere. Here? Not so much. The trolley system exists, sure, but it covers maybe 30% of where you actually need to go. And buses? They come when they come.

The numbers don’t lie: 69% of workers drive alone to work here. The average commute is 26 minutes by car versus 49 minutes by public transit. That’s assuming the trolley is running on time, which… let’s just say punctuality isn’t its strong suit.

The True Cost of Car Ownership

Here’s what nobody mentions in those “cost of living” calculators:

- Auto insurance: $1,872/year average (and that’s if you have a clean record)

- Gas: $4.78/gallon (I remember when it hit $6 during the pandemic—dark times)

- Parking: $10-25/day downtown, and good luck with street parking in the beach areas

Plus, California makes you jump through hoops when you move here. New driver’s license within 10 days, vehicle registration within 20 days, smog check, the whole nine yards. Budget about $500-800 for all the DMV fun.

Public Transit: It Tries, Bless Its Heart

The MTS trolley connects some key areas—UCSD, downtown, the border, a few beach communities. It’s clean, relatively safe, and costs $2.50 per ride. Monthly passes run $72, which isn’t bad.

But here’s the thing: it doesn’t go where most people live and work. If you’re commuting from Clairemont to Sorrento Valley, you’re looking at an hour-plus each way with multiple transfers. No thanks.

Utilities and Essential Services: The Hidden Costs

Electricity Bills That’ll Make You Cry

Nobody prepared me for San Diego Gas & Electric (SDG&E). These people are highway robbers in hard hats. Basic rate is 22.5 cents per kilowatt-hour, but use too much (which is easy when it’s 90 degrees and your apartment has no insulation), and you’re paying 55 cents per kilowatt-hour.

My first summer here, my electric bill hit $420. For a one-bedroom apartment. I called thinking there was a mistake. Nope, just summer in San Diego with an old AC unit.

Average monthly bills run $274-$378, and that’s being conservative. My friend with a house in Scripps Ranch? His August bill was $680. He installed solar panels the next month.

Water Bills and Everything Else

Water costs double the national average—around $80/month for basic usage. Internet runs $83-120/month depending on speed and provider. Cable? Don’t even bother unless you love throwing money away.

All told, budget $200-300/month for utilities. More if you like being comfortable in your own home during summer.

Healthcare and Insurance

Medical Costs Reality

Good news: San Diego has excellent healthcare. Sharp, Scripps, Kaiser—all solid systems with good coverage throughout the county.

Not-so-good news: A basic doctor’s visit runs about $147 compared to $120 nationally. Specialists? Hope you have good insurance, because a dermatologist visit cost me $340 out-of-pocket last year.

If your employer doesn’t offer health insurance, Covered California has decent options starting around $200-400/month for basic coverage, depending on your income and age.

Employment and Career Opportunities

The Job Market Reality

The job market here is decent—4.7% unemployment as of late 2024, which is pretty solid. But here’s what they don’t tell you: competition is fierce because everyone wants to live here.

Tech jobs are plentiful, especially in biotech and telecommunications. Qualcomm, Illumina, and dozens of smaller companies are always hiring. Salaries are good—$85K-150K+ for experienced developers—but they’re not Silicon Valley good, while the cost of living is Silicon Valley adjacent.

Healthcare is booming. Nurses start around $75K, experienced ones make $100K+. Physical therapists, medical assistants, technicians—all in demand. The aging population and constant stream of new residents keeps this sector growing.

Military and defense contracting is huge here. General Atomics, BAE Systems, Northrop Grumman—if you have security clearance and relevant experience, you’re golden.

Creative industries? Tough crowd. Tons of talented people fighting for limited positions. If you’re a graphic designer or photographer coming from a smaller market, prepare for a reality check on both competition and rates.

Lifestyle and Quality of Life

The Weather Everyone Talks About

Okay, fine—the weather really is spectacular. Average temperature between 57°F and 72°F year-round. We get about 344 days of sunshine annually. I haven’t owned a real winter coat in five years.

But it’s not perfect. June gloom is real—this marine layer that makes everything gray and cool for weeks. Fire season (September-November) can be genuinely scary, with hot, dry Santa Ana winds that make the whole region feel like a tinderbox.

And drought restrictions? They’re not theoretical. During bad years, you can’t water your lawn certain days, car washes shut down, and everyone becomes very aware of their shower length.

The Social Scene and What It Costs

The dining scene here is incredible—seriously, some of the best Mexican food outside of Mexico, amazing seafood, and a growing craft beer culture that’s hard to beat.

But eating out regularly will destroy your budget. Average dinner for two runs $60-80, and that’s without getting crazy. Cocktails are $12-18 each downtown. Even casual lunch spots charge $15-20 for a decent sandwich.

The free stuff is amazing though. Beach access everywhere, hiking trails in every direction, free concerts in Balboa Park. If you’re an outdoorsy person who can resist the temptation of expensive restaurants, you’ll love it.

Taxes and Legal Considerations

California’s Tax Appetite

California wants its cut, and it’s not shy about it. State income tax ranges from 1% to 12.3%, plus an additional 1% if you make over a million (must be nice, right?). Sales tax in San Diego is 7.75%, so add that to every purchase.

The good news? Property tax rates are relatively low compared to other states. The bad news? You’re paying property tax on a house that costs three times what it would elsewhere.

Moving Requirements and Red Tape

California doesn’t mess around with new residents. You have 10 days to get a California driver’s license and 20 days to register your vehicle. Miss these deadlines? Expect fines.

The DMV here is… an experience. Book appointments online or you’ll spend half a day waiting. Bring every document they ask for (plus backups) because they’ll turn you away for missing the most obscure paperwork.

The Honest Pros and Cons

What You’ll Actually Love

The weather is life-changing if you’re coming from a place with real winters. I wake up every December morning and still feel grateful. The outdoor lifestyle becomes part of your identity—hiking on weekends, beach days that don’t require planning, outdoor dining year-round.

The diversity is incredible. Food from everywhere, cultures mixing naturally, and generally progressive attitudes that make most people feel welcome. Plus, you’re two hours from mountains, two hours from desert, and 20 minutes from Mexico. The variety of landscapes is insane.

What Will Drive You Crazy

The cost of living is relentless. It’s not just rent—it’s everything. $8 for a beer, $6 for gas, $15 for parking. It adds up fast, and it never stops.

Traffic, despite what locals say, is getting worse. The 5, the 8, the 15—they’re all parking lots during rush hour. And don’t get me started on trying to get to the beach on weekends.

The homeless situation is heartbreaking and visible. Downtown, the beaches, even nice neighborhoods—it’s everywhere, and the city seems overwhelmed trying to address it.

Making the Decision: Practical Steps

Financial Preparation That Actually Matters

Before you book that U-Haul, make sure you have:

- Emergency fund: Six months of expenses minimum. I’m talking $25,000+ saved up

- Job lined up: Unless you’re in a high-demand field, don’t move first and hope for the best

- Moving budget: Cross-country moves run $3,000-8,000, plus all those upfront rental costs

Your Moving Timeline

3-6 months before: Start job hunting seriously. Network on LinkedIn, connect with San Diego professionals in your field. Research neighborhoods obsessively—use Google Street View, check commute times at different hours.

1-3 months before: Secure housing (good luck), start the utility transfer process, research school districts if you have kids. Book your moving company early—summer is peak season.

Moving week: Hit the DMV first thing, open a local bank account, register to vote, find a local doctor and dentist. Update your address everywhere—seriously, make a list because you’ll forget half of them.

Red Flags: When to Pump the Brakes

Don’t move to San Diego if:

- You make less than $70K and don’t have family money backing you up

- You hate driving and rely on public transit

- You need to buy a house soon and don’t have $200K+ for a down payment

- You get depressed by too much sunshine (it’s a real thing)

Your San Diego Decision Framework

Here’s the bottom line: San Diego is expensive as hell, but it might be worth it.

If you can swing the income requirements ($85K+ single, $110K+ family), enjoy outdoor activities, and value quality of life over financial flexibility, you’ll probably love it here. The weather, the food, the lifestyle—it’s pretty spectacular.

But if you’re stretching financially, hate traffic, or dream of homeownership, maybe look at Austin or Nashville instead. They’ve got their own charm and won’t leave you broke.

The people who thrive here usually fall into two categories: those making serious money in tech or healthcare, and those who’ve decided that life’s too short not to live somewhere beautiful, even if it means being house-poor forever.

What category are you?

The choice is yours, but at least now you know what you’re getting into. San Diego doesn’t keep secrets—it just lets the Instagram photos do the talking while reality handles the bill.

Leave a Reply